Payment Processing 101 E-Book

Credit card payment processing can be confusing. That’s why we’ve created this friendly e-book. Each chapter breaks down easy-to-understand concepts so you can process with peace of mind. Download our free e-book here and learn more about what we will do for your business.

What it includes:

Payment Processing Flow: Key Players

Ever wonder how a business gets paid when a customer swipes their credit or debit card during checkout? This chapter covers the steps of a simple (but complex) process. Read on to learn how several elements work together to collect a payment.

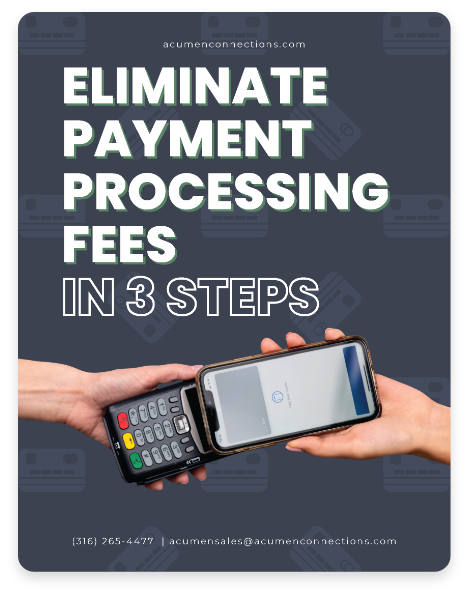

Eliminate Payment Processing Fees in 3 Steps

In this short e-book, Acumen Connections explains a simple 3-step process that will allow you to minimize your business’ processing fees.

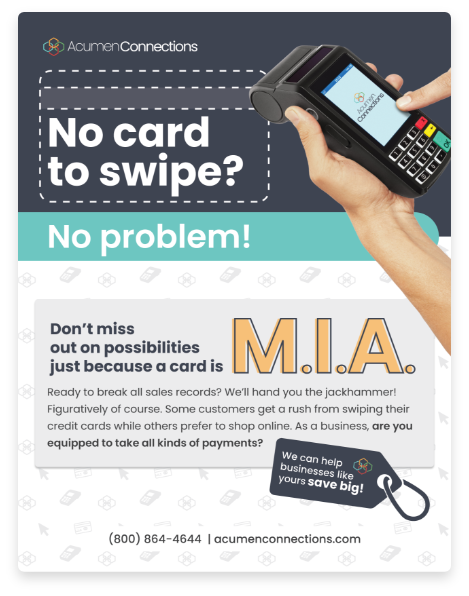

No Card to Swipe? No Problem!

As a business, are you equipped to take all kinds of payments? Master the art of secure, yet effortless card-not-present transactions with our exclusive e-book.

Learn more about dual pricing and payment processors.

Acumen has provided much more insight into this process and explained it in a way I finally understand the process front to back…it has helped tremendously to almost all areas of my business and most importantly: my bottom line!

Clayton

Acumen has been our processor for several years now and have been great to work with. Very helpful and extremely fair with their rates. Everyone has been great either on telephone or in person. Highly recommend.

Mark

We definitely would and will recommend that anyone should use Acumen for their services. The people that have handled our account have been always very helpful. They have always answered all of our concerns and questions with easy to understand answers.

Marla

Business Tips

Business Tips