Internal fraud can weaken your organization from the inside. Let us help you.

Fraudulent activity at a business can be committed by someone from within the organization. Discover how you can protect your business from becoming a victim of internal fraud or employee fraud.

Level up your payment game

Take payments with confidence. Make our YouTube channel your go-to for all things payment processing.

All companies are at risk of becoming victims of fraud. It is extremely important to gain awareness. Start with education on the topic. You don’t want your company to be affected by fraudulent activity as it could lead to a plethora of issues. Sometimes, businesses are simply unable to recover from the impact of fraud and eventually fail. To avoid unfavorable consequences, we believe that every business needs to take fraud seriously.

There are different categories of fraud. In this piece, we shall tackle internal fraud.

Here you’ll learn:

- What employee fraud is

- How common it is

- Why internal fraud happens

- How to identify it

- How to prevent it

As an employer, you hire people to run parts of your business. You expect them to perform their duties. Ideally, they’ll help the company meet goals, make money, and grow. Sadly, not every employee works towards that. Some might even have nefarious intentions or instincts.

What is internal fraud?

A company can be put at great risk due to the fraudulent actions of employees. This is termed internal fraud. It can cause financial, proprietary, and reputational damage.

Internal fraud comes in many forms. Let’s take a look.

Misuse of company funds or embezzlement

Misuse of company funds can happen in many ways. Most often, company funds are fraudulently used for personal expenses. A few examples include:

- A CFO using company funds to pay off a personal credit card bill

- A manager buying a “company car” on the company’s dime and not documenting personal use

- An employee using their per-diem meal allowance for non-food-related purchases

All of these misuse company funds for personal expenses. Sometimes it can be a small offense. Other times, a business may lose thousands of dollars!

Misappropriating payroll

Misappropriating payroll comes in two forms. Both are equally undesirable. In some cases, employees get paid more money than they deserve. In other cases, employers withhold earnings. Misappropriating payroll may be a one-person job. It could also be a cross-department collaboration.

Worker misclassification is one type of payroll misuse. Here, a manager will misclassify a direct employee as an independent contractor. They do this to avoid taxes or workers’ compensation insurance fees. Worker misclassification is illegal.

Another form is pay rate alterations. These happen when the payroll department temporarily changes an employee’s hourly pay without notice. They may raise or lower the employee’s hourly wage. Sometimes the bad actor will correct the rate right after payday to avoid getting caught.

Outstanding advances happen when an employee owes the company money. This is often in the form of a late pay advance. For example, if the employee receives a pay advance, they’re expected to pay it back in a set timeframe. If they do not pay it back, they’ve effectively taken money from the company.

One of the most common types of payroll misappropriation is time theft. Time theft is so common that it deserves its own section!

What is time theft?

You’ve probably heard of the term. You may not know its meaning. When an employee gets paid for time they didn’t work, it is called time theft. It is a type of payroll misappropriation. This tends to be more applicable to hourly employees.

Did you know that time theft committed by an average employee adds up to almost 6 days annually? Yes, it is that profound and costs businesses a lot of money each year.

Time theft is carried out in a few different ways. It can be done by falsifying time sheets. Some may ask a coworker to punch-in on their behalf. They could also be taking unauthorized breaks, making personal phone calls, and doing personal activities while on the clock.

Data leakage and data theft

In another blog, we talk about how human error is a major cause of data breaches. There may be a data breach if an employee clicks a phishing link. But what happens when an employee leaks confidential information on purpose? This is called data theft or data leakage.

The employee may believe there is financial or emotional gain in leaking the information. Here are a few examples:

- An account manager selling customer information to other businesses

- A disgruntled employee leaking confidential information like a secret recipe or customer data

- An IT employee being bribed or paid to open a security backdoor for hackers

Accounting fraud

Accounting fraud refers to altering a company’s financial statements. This is done to project a false image of the company’s financial health. Accounting fraud is carried out in many ways such as:

- Overstating revenue

- Understating expenses

- Incorrectly stating assets and liabilities

- Not disclosing risky investments

Like any other type of internal fraud, this has grave consequences. It can land a business in serious legal troubles.

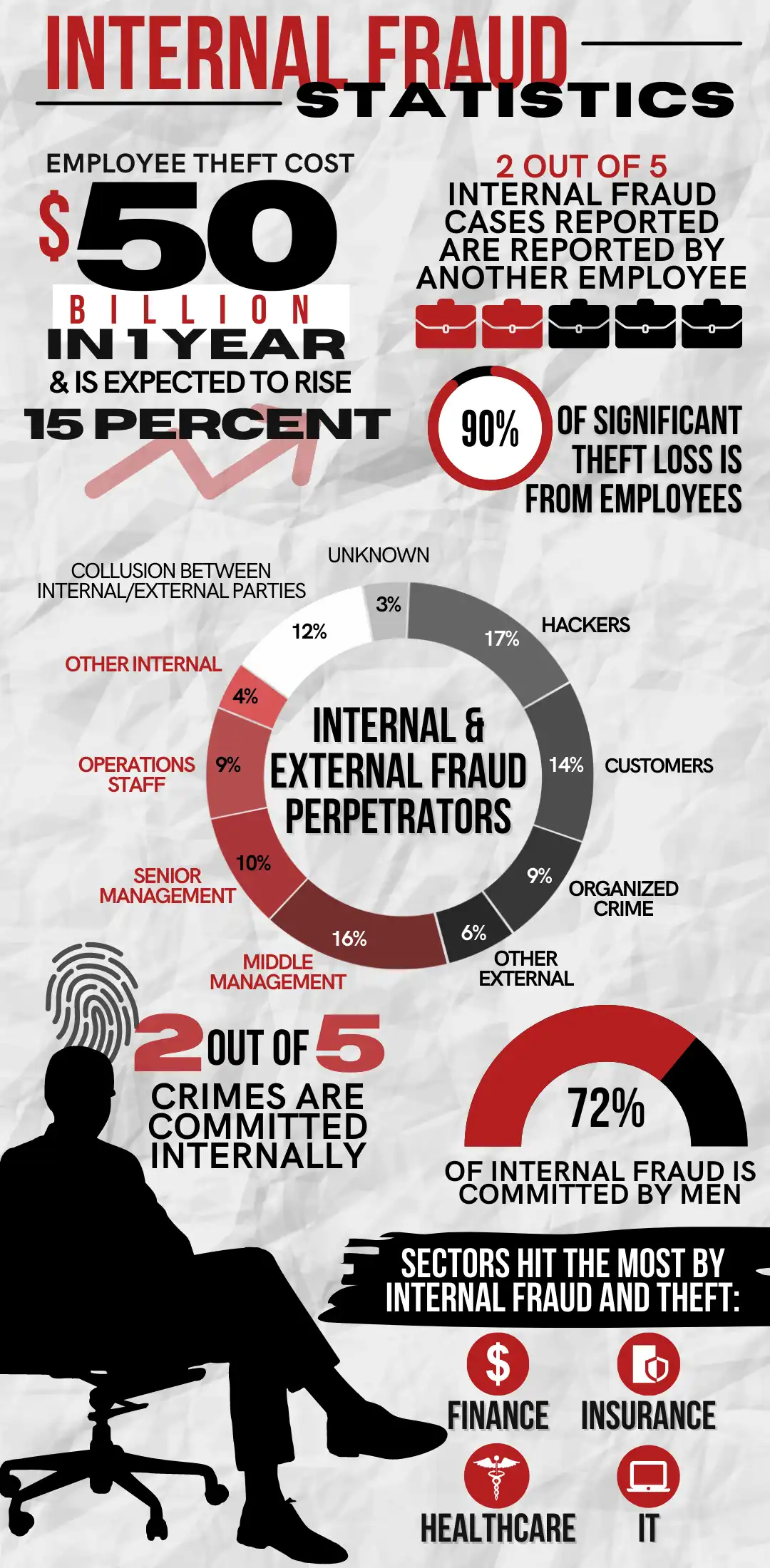

How common is internal fraud?

Companies lose 5% of their revenue to internal fraud every year. Internal fraud and employee theft are extremely common. Here’s a few fast facts you’ll want to know:

Graphic resources: Embroker & PWC

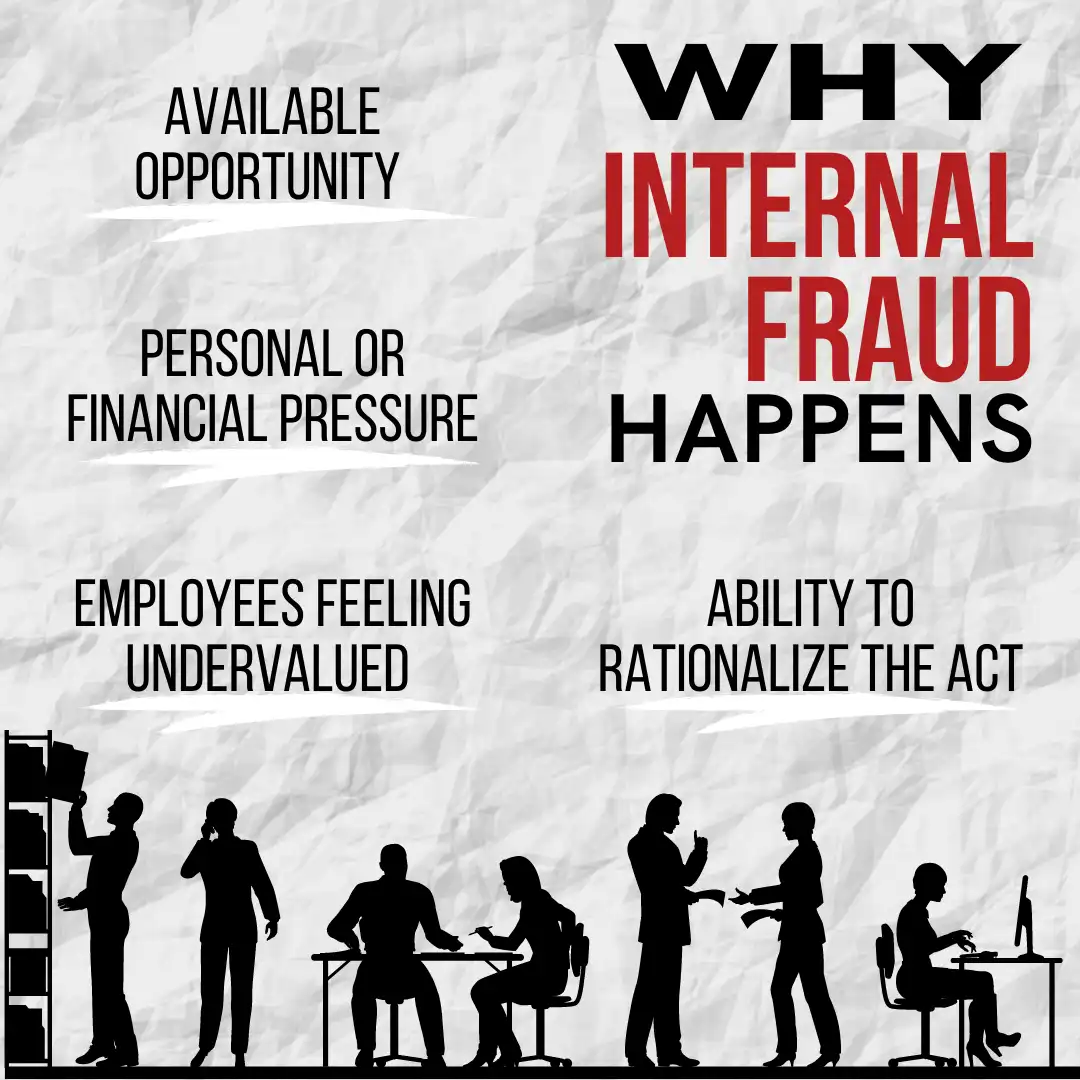

Why does internal fraud happen?

Before attempting to eliminate internal fraud, let’s look at the reasons fraud occurs. Internal fraud damages integrity. It could potentially dismantle an organization. That’s why it is important to identify the factors that contribute to fraud. The driving forces behind internal fraud are:

Personal or financial pressure

Need and greed can motivate people to commit unethical actions. As an employer, you can offer fair wages and perks to keep your staff satisfied.

Happy employees are less likely to commit fraud. However, you don’t know what personal or financial struggles an individual might be facing.

When times are desperate, people often resort to unscrupulous means. There are also some that aspire to live a lifestyle beyond their means. Their ideas of grandeur can trigger dishonest behavior that contributes to internal fraud.

Available opportunity

People may do something unethical or immoral simply because an opportunity presents itself. People can have weak moments and momentarily lack good judgement. This is likely to happen in workplaces with few controls in place.

Employees who have witnessed coworkers commit fraud and get away with it might be inclined to do the same. If you suspect fraud, it’s important to do something about it.

Employee feeling undervalued

In high-pressure and busy workplaces, sometimes employee efforts go unappreciated. Over time, this could build up serious resentment.

As human beings, we all like to be acknowledged for our contributions. Your employees crave the same. They want to be noticed and recognized for the work they do and the value they bring to your organization.

Toxic workplaces are quick to destroy employee morale and lose employee loyalty. Workers often feel trapped in their jobs. When this happens, negative thoughts creep up in their minds. Not everyone acts on these thoughts, but some might. It is easy to commit fraud against an employer that is seen as uncaring.

Employees may justify theft if they feel the company owes them. This leads us to the next reason behind why fraud occurs.

Ability to rationalize the act

Some people justify their actions even when they’re wrong. Call it a character trait, but entitlement is a real thing. These employees may feel like they are within reason to commit actions like time fraud. They feel like they deserve to enjoy some of the extras that can be acquired by underhand tactics.

How to identify internal fraud

There are a few red flags to watch for when identifying internal fraud. Be aware of these with employees:

- Sudden change in lifestyle

- Becoming hesitant or reluctant to share work for review

- Addiction or substance abuse problems

- Multiple inconsistencies and unexplained transactions

- Refusal to follow company procedures

Please know that an employee might upgrade their lifestyle due to an additional stream of income, inheriting money, a change in marital status, etc. Sometimes, people that live beyond their means are just poor financial planners.

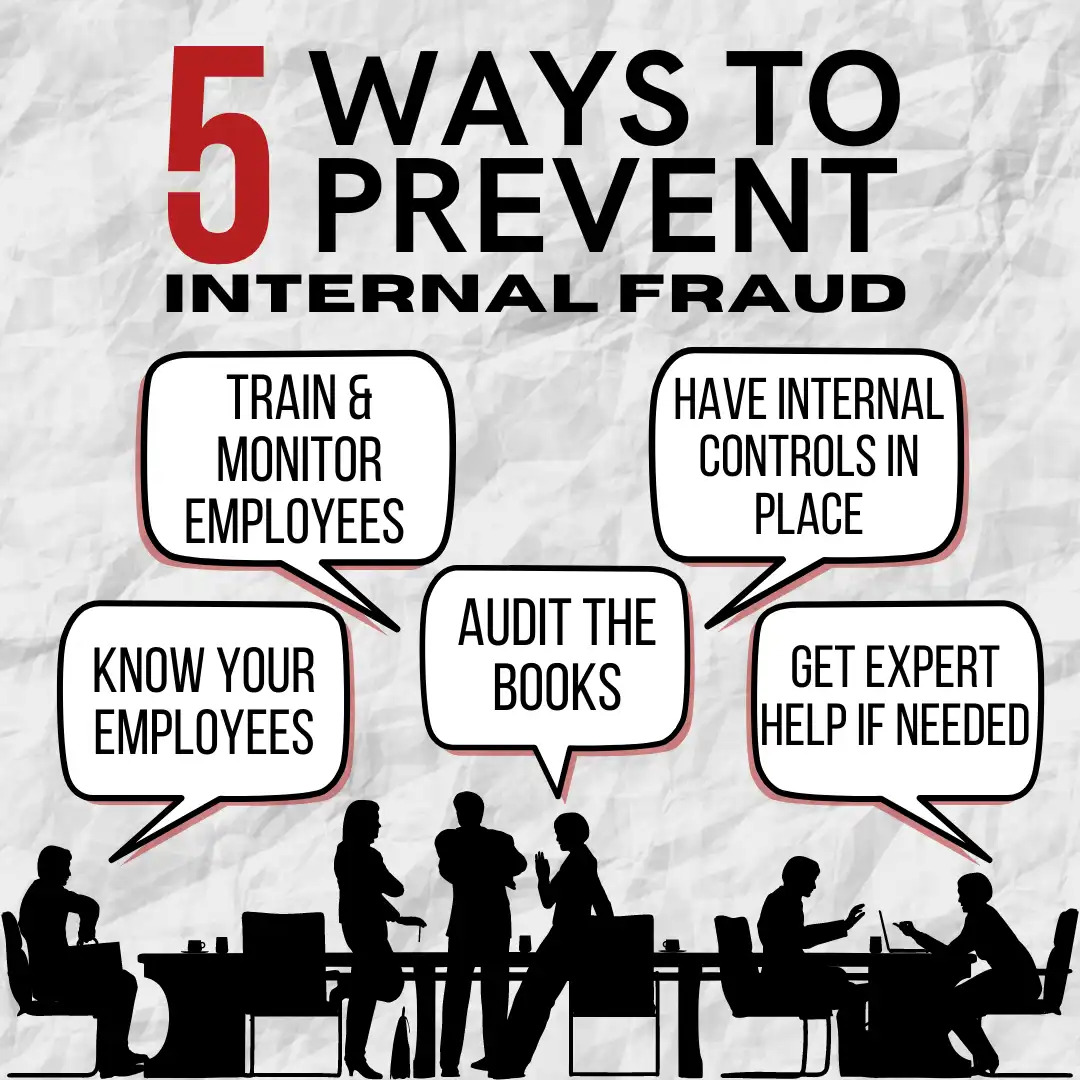

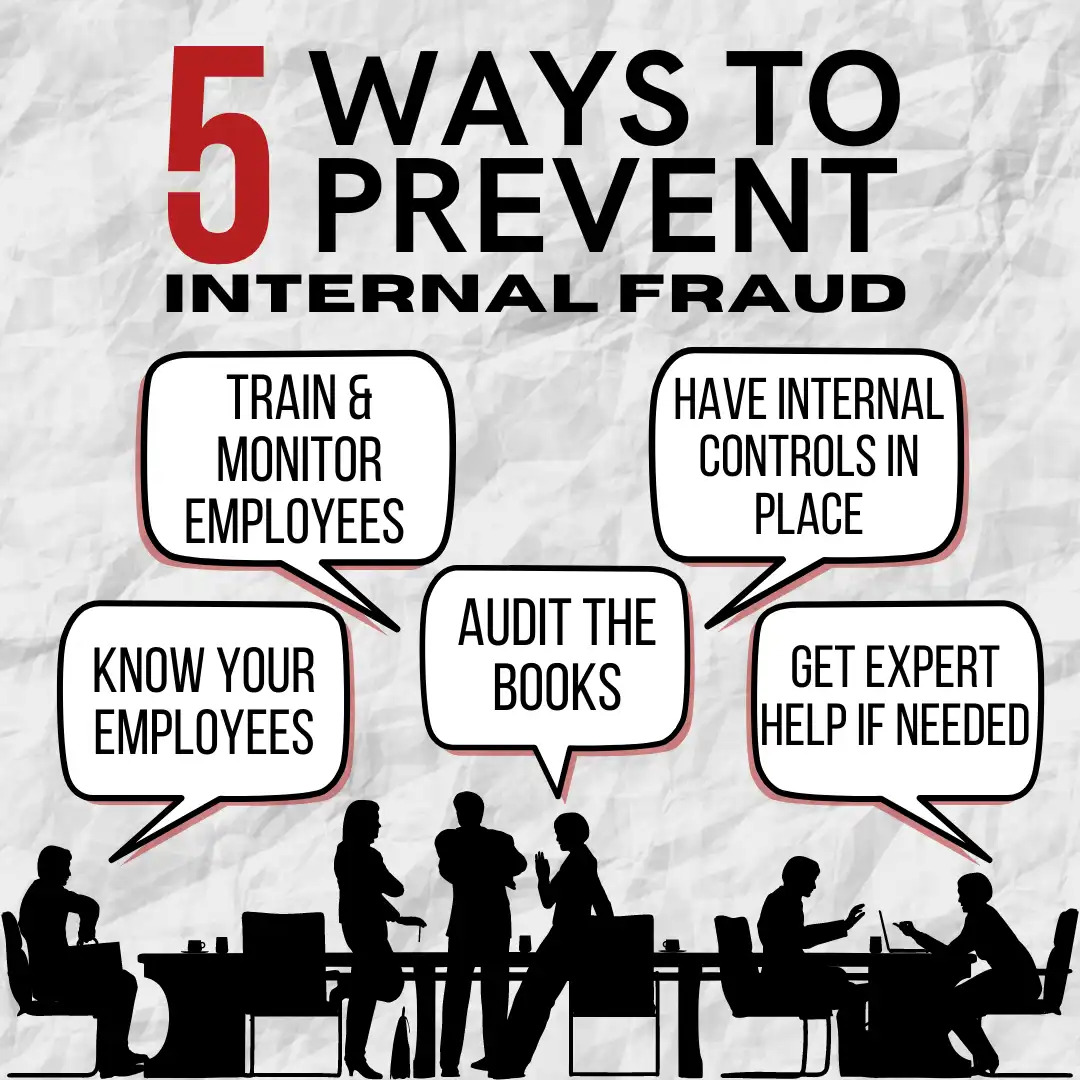

5 ways to prevent internal fraud

As a business owner, you want to avoid fraud at all costs.

Hiring honest work staff is crucial to the success of a business. It can be difficult to gauge honesty and integrity in a person. Therefore, it is advisable for companies to have systems in place that discourage internal fraud.

We recommend staying vigilant when it comes to the possibility of fraud. We’ve compiled a list below that could potentially help minimize internal fraud.

Know your employees

Knowing your staff enables you to take a closer look at their behaviors. Over time, it will help you notice anything that’s amiss. When you’re aware of your teammates’ daily habits, you’re more likely to see when something seems awry.

Establish open communication with your employees so that they’re comfortable sharing their problems. Internal fraud is often carried out by dissatisfied employees. That’s why we suggest getting to know your employees. Notice how they contribute to your company. Make sure to express your gratitude and acknowledge their efforts in front of the team. Boosting employee morale can greatly improve productivity and performance.

Knowing your employees also means they’re more likely to come to you when they face issues. This can prevent them from going behind your back, which may lead to fraud. Plus, it gives you a chance to help them, which is a win-win!

Audit the books

Numbers don’t lie. When you audit your books, you are bound to notice inconsistencies if any.

In addition, it sends a message to your staff that you’re actively monitoring accounting and bookkeeping. It tells your team that any wrongdoing will be easily noticed. Stay up to date with your invoices, receipts, and refunds. Also monitor your returns, inventory tracking, cash handling, and other accounting functions.

Train and monitor employees

Your company heavily relies on your workforce. Therefore, it is necessary that you train your employees to detect fraud.

This helps them stay accountable for their own actions and be mindful of those around them. Enforce the code of ethics and inform employees that unethical actions will have consequences.

When unethical actions happen, it’s important to take action. Fraud can put an organization and its customers at risk. Employees need to be made aware of the consequences. They should also know the importance of fair repercussions. Issues shouldn’t be swept under the rug but tackled and resolved. You can’t let your staff think that one can get away with unethical behavior.

Have internal controls in place

Regardless of size, structure, or industry, every business needs to have internal controls to prevent fraud. Limiting access to data, inventory, website admin, time sheet, or accounting functions is a great start.

Fewer people having restricted access narrows the pool of suspects should anything happen. It also keeps these employees more watchful.

Did you know that 2 out of 5 internal fraud cases reported are reported by another employee? We suggest setting up an anonymous reporting system. Employees can use this to report alleged wrongdoings by coworkers. Having an anonymous system helps ensure employee fraud and theft are reported. It also provides security and peace of mind to the employee reporting.

Here’s how to set up an anonymous reporting system.

Get expert help if needed

Fraud can seriously impair a company’s ability to function. There could be dire effects if your business gets caught up in fraudulent activity. Even if you’re doing all you can to mitigate the situation, it is never a bad idea to seek help. A Certified Public Accountant can help make sense of the inconsistencies in your books. You can seek help from Certified Fraud Examiners to help detect and prosecute fraudsters in your company. These measures do sound extreme but they’re available should you ever need them.

Conclusion:

As a business owner, it is your duty to protect your company. In addition to external factors, there are internal agents that can create problems. The first step is to be aware of what you could be potentially up against. We recommend taking the time to consult our resources:

Anna Reeve, MBA